Rebuilding Credit After Financial Hardship

Financial hardships, whether due to job loss, medical emergencies, or other unforeseen circumstances, can take a toll on your credit score. However, the road to recovery, while challenging, is achievable. Here’s a guide to help you rebuild your credit after facing financial difficulties.

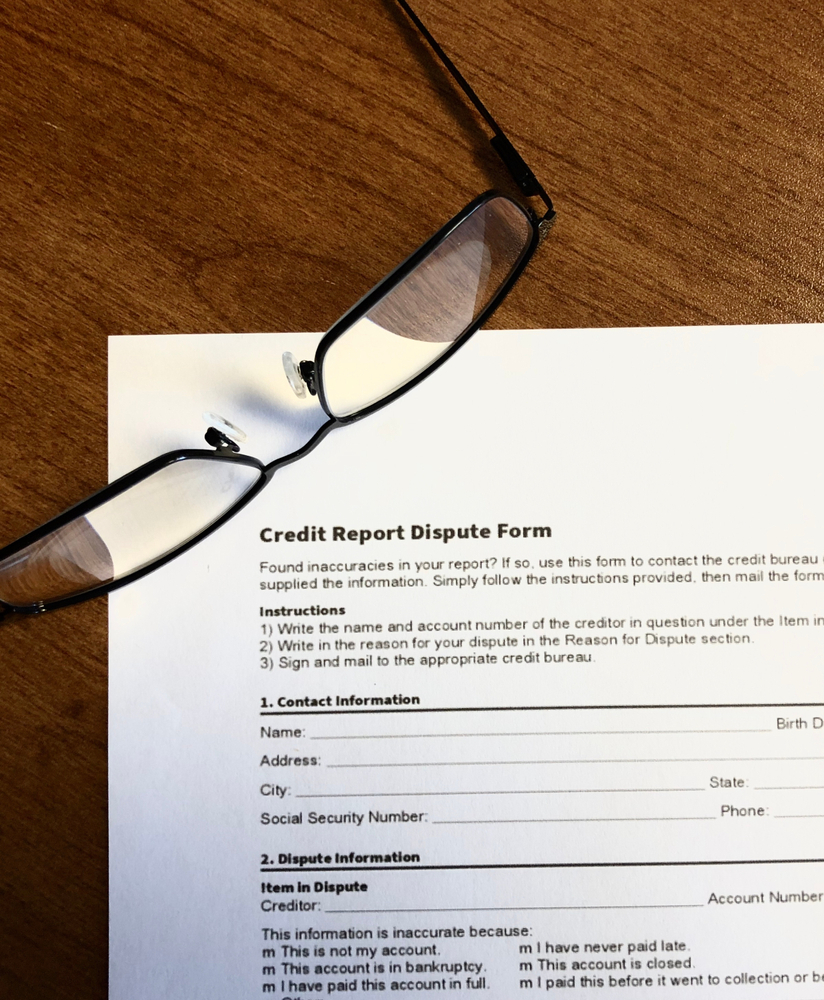

1. Assess the Damage

Start by obtaining your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. Review the report to understand the extent of the damage and identify areas that need immediate attention.

2. Set Up Payment Plans

If you have outstanding debts, reach out to your creditors. Many are willing to set up payment plans or negotiate terms. This gesture shows initiative and can prevent further damage to your credit.

3. Prioritize Payments

Focus on paying off high-interest debts first, as they accumulate faster. Ensure you’re also staying current with all other bills to prevent new negative marks on your report.

4. Consider a Secured Credit Card

Secured credit cards require a deposit, which serves as your credit limit. They’re designed for individuals looking to rebuild their credit. Use it sparingly and pay off the balance in full each month.

5. Become an Authorized User

If a family member or close friend has a good credit history, they might consider adding you as an authorized user on their credit card. This can help boost your credit, but ensure they maintain good credit habits.

6. Diversify Your Credit

A mix of credit types – credit cards, retail accounts, installment loans – can positively impact your score. However, only open new credit accounts when necessary.

7. Avoid New Hard Inquiries

Each time a lender checks your credit for lending purposes, it can slightly reduce your score. Limit new credit applications to avoid these dings.

8. Monitor Your Progress

Regularly check your credit report to track improvements and ensure no inaccuracies creep in. Consider using credit monitoring services that alert you to significant changes.

9. Seek Professional Help

Credit counseling agencies can offer guidance and help you develop a debt management plan. Ensure you choose a reputable agency, preferably a non-profit.

10. Stay Patient and Persistent

Rebuilding credit is a marathon, not a sprint. Celebrate small victories along the way and stay committed to healthy financial habits.

Conclusion

While financial hardships can be daunting, they don’t define your financial future. With determination, discipline, and the right strategies, you can rebuild your credit and pave the way for a brighter financial horizon.