The Role of Credit Repair Companies: Pros, Cons, and Alternatives

In the quest to improve credit scores, many individuals turn to credit repair companies. These firms promise to help clean up your credit report and boost your score. But are they the right solution for everyone? Let’s explore what these companies offer, their advantages, potential drawbacks, and other avenues to consider.

1. What Do Credit Repair Companies Do?

Credit repair companies analyze your credit reports and address negative items that could be inaccurate, outdated, or unverifiable. They:

- Dispute inaccuracies with credit bureaus

- Negotiate with creditors to resolve disputes

- Offer advice on improving credit scores

2. Pros of Using Credit Repair Companies

- Expertise: These firms understand the nuances of credit laws and can navigate the dispute process more efficiently than individuals.

- Time-saving: Disputing items can be time-consuming. A credit repair company handles the legwork, saving you time and effort.

- Negotiation Power: With their experience, these companies might be more successful in negotiating with creditors.

3. Cons of Using Credit Repair Companies

- Cost: Engaging a credit repair company can be expensive. Fees vary, but many charge monthly rates or per item removed.

- No Guaranteed Results: While they can dispute inaccuracies, there’s no guarantee of a significant credit score increase.

- Potential Scams: The credit repair industry has its share of fraudulent companies. It’s crucial to research and choose reputable firms.

4. Things to Watch Out For

- Too-Good-To-Be-True Claims: Be wary of companies promising to remove all negative items or guaranteeing a specific credit score jump.

- Upfront Fees: It’s illegal for credit repair companies to charge fees before they’ve performed services. Avoid firms that demand upfront payment.

- Lack of Transparency: Reputable companies should be willing to explain their services, fees, and your rights.

5. Alternatives to Consider

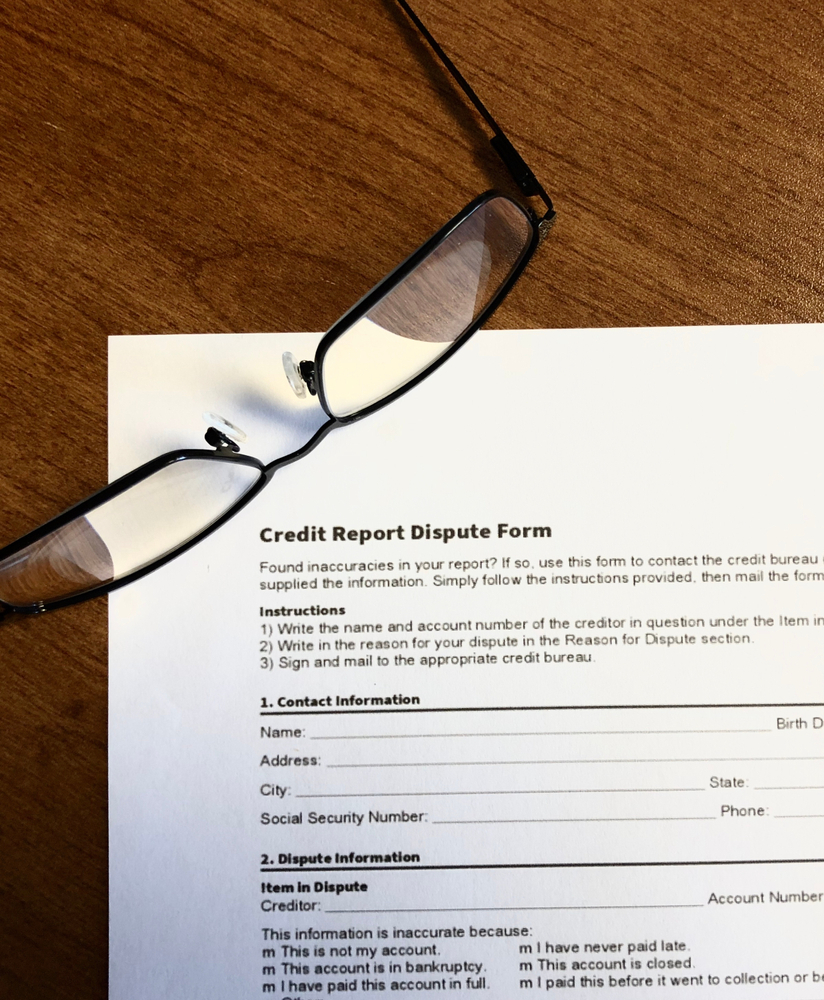

- DIY Credit Repair: With resources available online, many individuals successfully dispute inaccuracies themselves.

- Credit Counseling: Non-profit credit counseling agencies can offer guidance, helping you manage debt and improve your financial habits.

- Debt Management Plans: These plans, offered by credit counseling agencies, can help you pay off debt over time, potentially improving your credit.

6. Making the Decision

If you’re considering a credit repair company:

- Research the company’s reputation and reviews.

- Understand the fees and contract terms.

- Weigh the potential benefits against the costs.

Conclusion

Credit repair companies can be a valuable resource for those looking to address inaccuracies in their credit reports. However, it’s essential to approach with caution, understand the potential pitfalls, and consider alternative solutions. By making informed decisions, you can take control of your credit journey and work towards a brighter financial future.