Understanding Secured vs. Unsecured Loans: Which is Right for You?

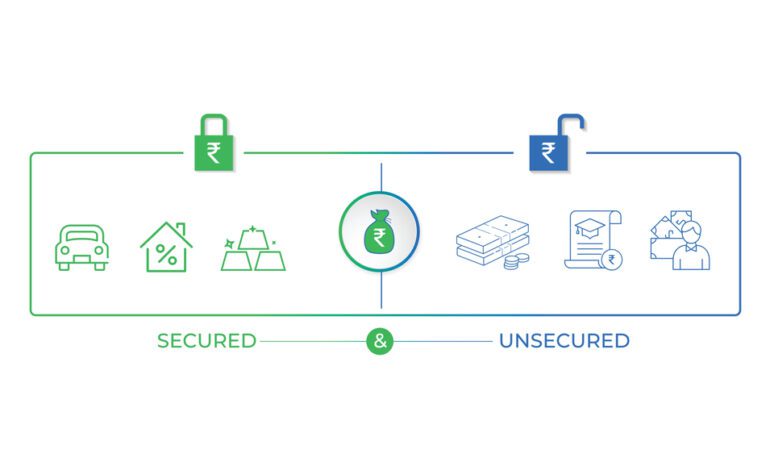

When seeking a loan, you’ll often encounter two primary types: secured and unsecured. Each has its unique features, benefits, and considerations. Let’s demystify these loan types to help you determine the best fit for your financial needs.

1. Secured Loans: The Basics

Secured loans require collateral, an asset that the lender can seize if you default on the loan. Common examples include mortgages (with the house as collateral) and car loans (with the car as collateral).

Pros:

- Lower Interest Rates: The presence of collateral often results in lower interest rates compared to unsecured loans.

- Higher Borrowing Limits: Lenders may offer larger loan amounts since they have the security of the collateral.

- Easier Approval: Even with a lower credit score, you might qualify due to the reduced risk for the lender.

Cons:

- Risk of Losing Assets: If you default, the lender can take the collateral, which might be a vital asset like your home or car.

- Potential for Longer Terms: Some secured loans, like mortgages, can have extended repayment periods, leading to more interest paid over time.

2. Unsecured Loans: The Basics

Unsecured loans don’t require collateral. Instead, they’re based on your creditworthiness. Personal loans, student loans, and most credit cards fall into this category.

Pros:

- No Risk to Personal Assets: Since there’s no collateral, your assets aren’t directly at risk if you default.

- Faster Approval Process: Without the need to evaluate collateral, the loan approval process can be quicker.

- Flexibility: Unsecured loans can be used for various purposes, from consolidating debt to funding a vacation.

Cons:

- Higher Interest Rates: Lenders might charge higher rates due to the increased risk.

- Lower Loan Amounts: You might not be able to borrow as much as with a secured loan.

- Stricter Credit Requirements: Good credit is often essential for favorable terms and approval.

3. Which is Right for You?

Consider the following:

- Purpose of the Loan: If you’re buying a house or car, a secured loan is standard. For general expenses or debt consolidation, an unsecured loan might be more fitting.

- Your Financial Stability: If you’re confident in your ability to repay and want lower rates, a secured loan can be beneficial. If you’re wary of risking assets, consider unsecured options.

- Loan Amount and Terms: Determine how much you need and your ideal repayment period. This can guide your choice between the two.

4. Always Shop Around

Regardless of the loan type:

- Compare Rates: Different lenders offer varying terms and rates. Shop around to find the best deal.

- Understand All Terms: Beyond interest rates, be aware of any fees, penalties, and other terms.

Conclusion

Both secured and unsecured loans have their place in personal finance. By understanding their characteristics and weighing their pros and cons against your financial situation and goals, you can secure the best loan for your needs and future.